April 15, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The ISM Manufacturing Index was 50.3 for March, while the PMI Manufacturing Index was 51.9 for March. Durable Goods Orders were up 1.3% in February and Producer Prices were up 0.2% in March and 2.1% year over year. The ISM Service Index came in at 51.4 for March, similar to the PMI Services Index, which came in at 51.7. The U.S. Unemployment Rate was 3.8% in March, down slightly from the 3.9% in February. The NFIB Small Business Index was still reasonably strong, at 88.5 for March. The University of Michigan Sentiment Index was relatively neutral, at 77.9 for April. The NAHB Housing Market Index is still straddling 50.0, with a 51.0 reading for April. Consumer Prices were up 0.4% in March and 3.5% year-over-year. Finally, Average Hourly Earnings were up 4.1% year over year, for the period ending March 2024.

Fixed Income

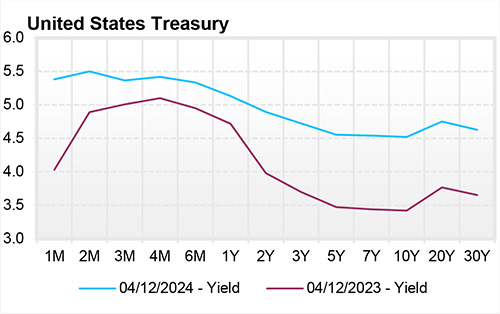

The U.S. Treasury Yield Curve remains inverted; however, this inversion has continued to remain somewhat flat. The 10-year yield is currently 4.658%, 31 basis points below the 2-year yield of 4.968%. The U.S. Treasury Yield Curve has now been inverted for 21 months. The next FOMC meeting is scheduled for May 1, 2024. The 1-year TBILL currently yields 5.173%, so using this simple yet effective data point, the market is now pricing in a 30% chance the FOMC cuts rates by this time next year.

Yield Curve

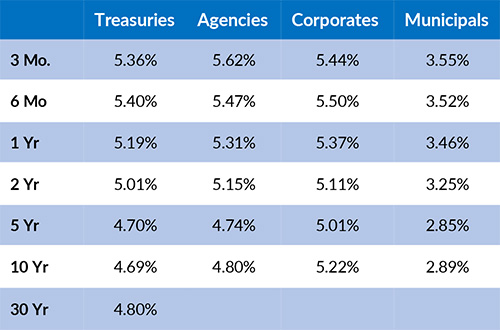

Current Generic Bond Yields

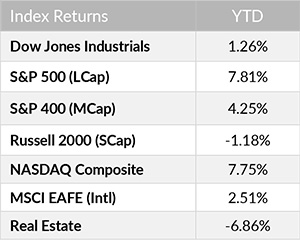

Equity

US Equities have experienced a strong start to 2024, with the S&P 500 up nearly 8% through mid-April. With Q1 in the books, 83% of S&P 500 companies reported a positive EPS surprise during the period (Factset). Markets experienced a small selloff in recent days with geopolitical risks cited as the primary culprit. Communication Services has led all S&P 500 sectors this year with a return of +17.82%. Other outperformers include Energy (+14.83%) and Information Technology (+11.11%).

The gap between Growth and Value equity returns has widened over the past two weeks. Year-to-date, value stocks are up 3.03% while growth stocks are up 11.73%. Real Estate is the only sector with a negative return in 2024 (-7.20%). Other laggards this year include Health Care (+1.79%) and Utilities (+1.29%).

Related Articles

March 1, 2024

The U.S. Index of Leading Economic Indicators was down 0.40% in January versus having been down 0.20% in December.

March 15, 2023

The ISM Manufacturing Index was 47.8% for February, a bit lower than the 49.1 level for January.

April 1, 2024

U.S. Industrial Production was up 0.10% for February, after having been down 0.50% in February.