January 1, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The U.S. Index of Leading Economic Indicators was down 1.0% in November versus having been down 0.90% in October. The Chicago Purchasing Manager’s Index was still in contracting territory in December, at 44.9 versus 37.9 in November. Finally, the NAHB Housing Index came in at a very low 31 for December versus 33 for November (50 is the median score). Otherwise, a slow two weeks for economic releases.

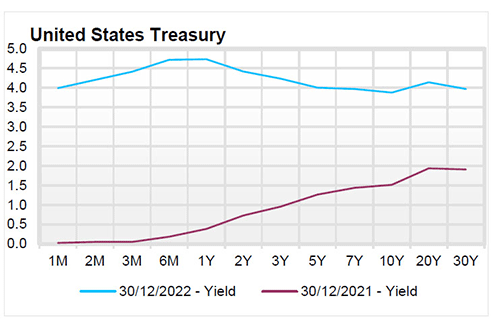

Fixed Income

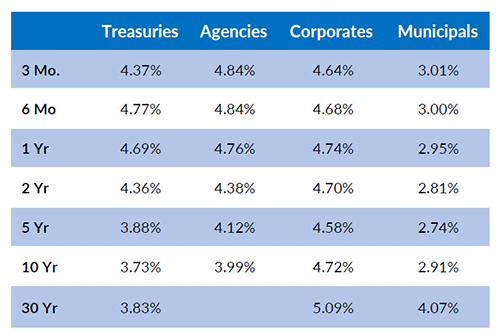

The U.S. Treasury Yield Curve remains inverted, with the 10-year yield trading at 3.71%, 75 basis points below the 2-year yield of 4.46% (the yields are moving daily and as such may be slightly different than the table below). Overall yields have shifted back up from two weeks ago. Nothing much new to report out of the Federal Reserve Open Market Committee, with exception to the continued verbal commitment to keep interest rates high until inflation moves meaningfully down on an annualized basis. The most recent Federal Funds rate increase left the Federal Funds rate range at 4.25% to 4.50%.

Yield Curve

Current Generic Bond Yields

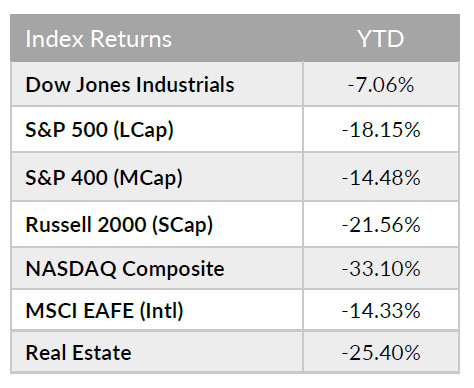

Equity

Major US Indices were down for 2022 with the S&P 500 and Nasdaq logging their worst calendar year losses since 2008. The S&P 500 hit all-time highs on January 3rd of 2022 before starting its downward trajectory to break into bear market territory in June and hitting a closing price low of 3577 on October 12th. Surging inflation was the overarching theme for the year which caused obvious pressures on consumers and businesses but also led to the aggressive policy response from Central Banks. This response started with a 25bps rise in January, a 50bps in May, four straight 75bps hikes going forward to then end the year with a 50bps change. Since then, the mantra of higher for longer has held, and the expectation is two potential 25bps hikes in 2023 with rates potentially coming back down late 2023; however, this can change with new data.

The S&P 500 ended the year down -18.15% with Communication Services (-37.54%) Consumer Discretionary (-36.19%), and Technology (-27.69%) struggling the most. Energy (+63.41%) and Utilities (+1.37%) were the only positive sectors for the year.