November 15, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

U.S. Durable Good Orders were up 4.6% annualized in September after having a similar increase in August. The Markit PMI Index came in at 50 in October, the same level as September. The ISM Manufacturing Index came in at 46.7 for October versus 49.0 for September. U.S. Productivity was up 4.7% in the third quarter of 2023, an acceleration from the 3.6% increase in the second quarter. The Markit PMI Services Index came in at 50.6 for October versus 50.9 for September. The ISM Services PMI came in at 51.8 for October versus 53.6 for September. The University of Michigan Sentiment data came in at 60.4 for November, down from the already low 63.8 for October. The NFIB Small Business Index came in surprisingly strong, at 90.7 for October. The U.S. Unemployment Rate was 3.9% in October. Average Hourly Earnings were up 0.20% for October and up 4.1% year over year. Consumer Prices were flat in October and up 3.2% year over year. Producer Prices were down 0.5% in October and up 1.3% year over year.

Fixed Income

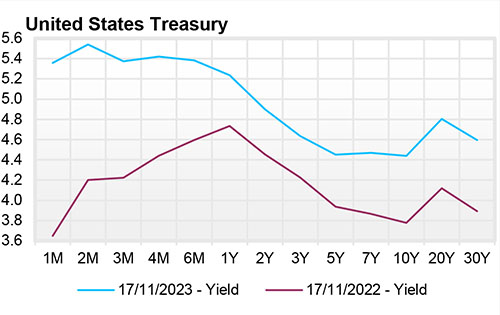

The U.S. Treasury Yield Curve remains inverted, however this inversion has continued to stay flatter somewhat, with the 10-year yield at 4.43%, 47 basis points below the 2-year yield of 4.90%. The U.S. Treasury Yield Curve has now been inverted for 16 months. At its recent September meeting, the FOMC left the Federal Funds target rate range at 5.25% - 5.50%. The FOMC kept rates in this band in its October/November meeting. The three-month and six-month U.S. Treasury Bills currently yield in a range of 5.23%-5.38%, which is within the range of the FOMC’s current Fed Funds rate target.

Yield Curve

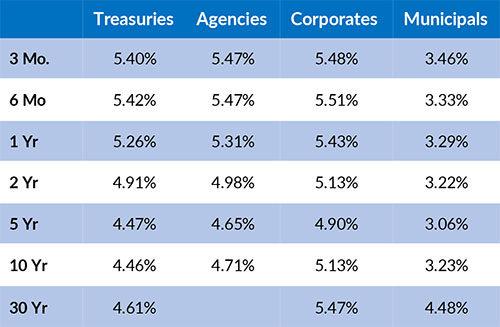

Current Generic Bond Yields

Equity

US equity is up as the S&P 500 continues its third straight week of gains. With October posting negative numbers, it’s no surprise the index is rallying this month as we head into the holiday season. Disinflation optimism and the weaker labor market helped fuel the rally as this seems to support the peak Fed narrative and soft landing narrative, which was solidified by CPI coming in lower than expected.

All sectors are higher month-to-date as Technology (+10.19) continues to lead the way, while Energy is lagging the rest (+0.28%). Large, mid, and small cap indices have seen large returns month-to-date with the Russell 2000 outperforming and posting its second best weekly performance of the year as the index shows some life after a difficult year.

Related Articles

September 1, 2023

U.S. Retail Sales were up 0.70% for July after having been up 0.30% in June.

September 15, 2023

U.S. Durable Goods Orders were down 5.2% in July versus having been down 5.2% in June.

November 1, 2023

U.S. Industrial Production was up 0.30% in September after having been flat in August.