December 15, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

U.S. Durable Goods Orders were down 5.4% in October. Industrial Production was up 0.2% in November and Capacity Utilization came in at 78.8%. The Markit Purchasing Managers’ index came in at 49.4 for November and the ISM Manufacturing Index was 46.7 for November. The Markit PMI Services Index was 50.8 for November while the ISM Services PMI was 52.7 for November. Third quarter U.S. Productivity was a strong 5.2% annualized, while Unit Labor Costs were down 1.2% for the third quarter. The U.S. Unemployment Rate was 3.7% for November. Producer Prices were flat for November and were up only 0.86% year-over-year. Consumer prices were essentially flat for November and were up 3.1% year over year. Average Hourly Earnings were up 0.40% for November and up 4.0% year over year.

Fixed Income

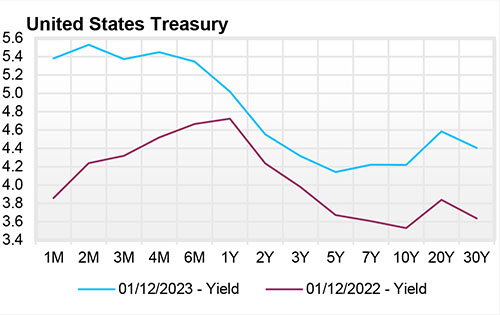

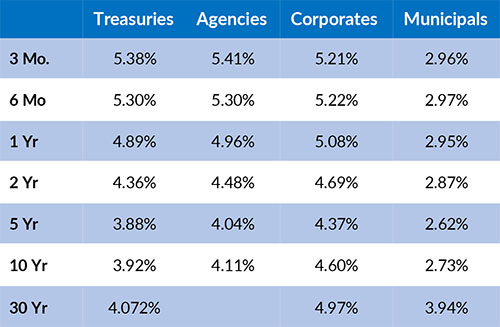

The U.S. Treasury Yield Curve remains inverted; however, this inversion has continued to remain somewhat flatter, with the 10-year yield at 3.96%, 50 basis points below the 2-year yield of 4.46%. The U.S. Treasury Yield Curve has now been inverted for 17 months. At its recent meeting, the FOMC left the Federal Funds target rate range at 5.25% - 5.50%. The FOMC also removed language that implied future interest rate increases and introduced language the implied future interest rate cuts. The FOMC also noted that the U.S. Unemployment Rate will likely continue trending higher to the 4.1% level. The three-month and six-month U.S. Treasury Bills currently yield in a range of 4.96%-5.38%, which is within the range of the FOMC’s current Fed Funds rate target but also now 0.25% below target on the one-year T-Bill.

Yield Curve

Current Generic Bond Yields

Equity

US equity is wrapping up the year strong. Federal Chairman Powell noted in the Dec. 14 meeting, “We are likely at or near the peak of this rate cycle; I think it’s not likely that we will hike, although we don’t take that possibility off the table.” Investors embraced the Federal Reserve’s commentary on future rate cuts and are pricing in multiple cuts during 2024.

The mid cap and small cap indices have turned sharply higher, with a (+8.5%) increase in small cap and (+10.75%) increase in mid cap returns over the last month. Year to date, the strongest sectors have been Consumer Discretionary (+40.36%), Communication Services (+48.24%), and Information Technology (+54.99%). The sectors lagging behind are Energy (-4.55%) , Utilities (-7.08%) , Consumer Staples (-2.83%) , and Health Care (-0.79%). Growth stocks have outpaced Value stocks by 30%, largely due to the outperformance of the technology sector.

Related Articles

November 1, 2023

U.S. Industrial Production was up 0.30% in September after having been flat in August.

November 15, 2023

U.S. Durable Good Orders were up 4.6% annualized in September after having a similar increase in August.

December 1, 2023

U.S. Durable Goods Orders were down 5.4% in October versus having been up in September.