October 15, 2024

Economic Outlook

The Markit PMI Manufacturing Index declined to 47.3 for September, as output and new orders fell. The ISM Services PMI came in at 54.9 for September, a sharp increase that printed above forecasts. During the same period, the NFIB Small Business Optimism Index increased to 91.5, still below the long-run average. Additionally, the Small Business Uncertainty Index reached the lowest reading on record for September. The U.S. Unemployment Rate fell to 4.1% for September, signaling a stable labor market. The Producer Price Index remained unchanged month over month. Producer prices have risen 1.8% from a year ago, the lowest annual change since February 2024. The Consumer Price Index again rose by 0.2% month over month. Notably, consumer energy prices have decreased by 4.83% from a year ago. Overall, consumer prices have increased 2.4% annually, the lowest annual change since February 2021. The week ahead is poised to be light regarding new economic data. Major releases include September data for Industrial Production and Retail Sales each on October 17. The average interest rate for a 30-year fixed rate mortgage is back up to 6.32%.

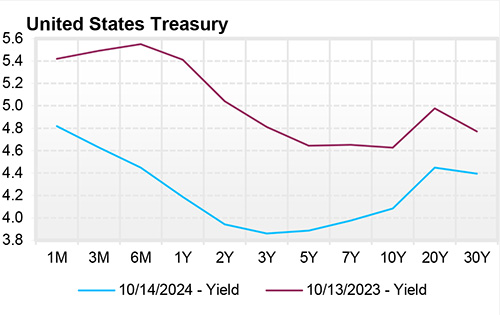

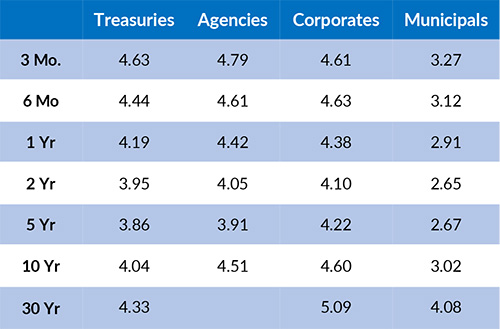

Fixed Income

The current federal funds target rate is 4.75-5.00%. Yields on Treasury bills with durations of 1-6 months have been flat since the FOMC cut its target rate. On the other hand, Treasury bonds with durations greater than 1 year continue to rise slightly. Bond markets are beginning to price in a longer rate-cutting cycle with smaller or staggered future rate cuts. The options market overwhelmingly anticipates a year-end federal funds target rate of 4.25-4.50% which implies a base-case scenario of 25 bps cuts at the November and December meetings. The 10-year yield is currently 4.04%, 9 basis points above the 2-year yield of 3.95%. The next FOMC meeting is scheduled for November 6-7, 2024.

Yield Curve

Current Generic Bond Yields

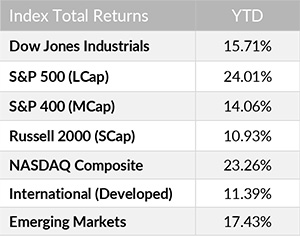

Equity

Looking back on Q3, market breadth was strong for large-cap U.S. stocks. In fact, the average stock in the S&P 500 returned 9.2% compared to the index’s return of 5.4%. Nearly two-thirds of the S&P 500 constituents outperformed the overall index. Taking a step back, the current bull market is now entering year two. Bull markets that last over two years have historically gained 195% from start to finish, compared to the current bull market’s return of 63%.

Year to date, the best performing sectors have been Information Technology (+33.98%), Communication Services (+28.54%), and Utilities (+26.61%). The worst performing sectors this year have been Real Estate (+9.00%), Consumer Discretionary (+11.44%), and Energy (+11.46%). On a total return basis, the Russell 1000 Growth Index has increased 25.52% year to date, while the Russell 1000 Value Index has returned 16.92% over the same period.

Related Articles

October 1, 2024

Final revisions for US GDP confirmed a 3% growth rate during Q2, up from a growth rate of 1.6% for Q1.

September 15, 2024

The Markit PMI Manufacturing Index came in at 47.9 for August, confirming a trend of weakness in the manufacturing sector.