November 1, 2024

Economic Outlook

The ISM Manufacturing Index was 46.5 for the month of October. Job growth slowed in October, largely due to natural disasters and labor strikes, as the U.S. added 12k jobs versus expectations of 111k. However, the unemployment rate remained unchanged at 4.1% for October. The NHAB Housing Market Index was 43 for the month of October, indicating a slight improvement in conditions for home builders. The US Leading Economic Index was 100.4 for the month of July, the lowest reading since 2016. U.S. Industrial production decreased -0.3% month over month in September. The University of Michigan Consumer Sentiment Index came in at a final reading of 70.5 for October, reaching its highest level in six months. Capacity Utilization in the U.S. dropped to 77.5%, now 2.2% below its long-run average. The final print for Consumer 1-Year Inflation Expectations in October remained at a multi-year low of 2.7%. The average interest rate for a 30-year fixed rate mortgage has risen to 6.72.

Fixed Income

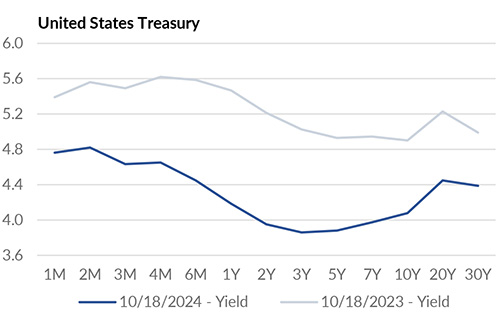

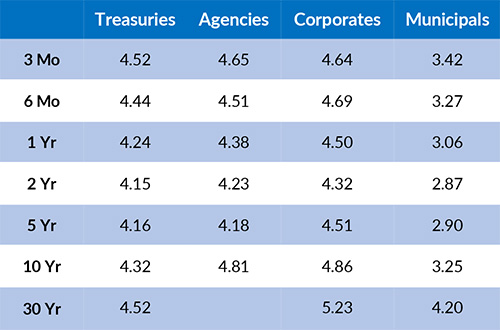

The current federal funds target rate remains at 4.75-5.00%. The 10-year yield is currently 4.32%, 17 basis points above the 2-year yield of 4.15%. Yields on Treasury bills with durations of 1-3 months continue to fall as additional rate cuts are expected by year-end. On the other hand, Treasury bonds with durations greater than 1 year remain elevated since the FOMC’s September meeting. Bond markets continue to price in a longer rate-cutting cycle with smaller or staggered rate cuts next year seeming more likely. The options market has fully priced in a 25 bps rate cut at the next FOMC meeting scheduled for November 6-7, 2024.

Yield Curve

Current Generic Bond Yields

Equity

Stocks fell in October as the S&P 500 broke a streak of five straight monthly gains. Meanwhile, the Nasdaq Composite was lower for the first time in three months. October marked the start of Q3 earnings season. With around 65% of S&P 500 companies having reported, the Q3 blended EPS growth rate of 6.7% is above the 4.3% expected at the end of the quarter.

Year to date, the best performing sectors have been Communication Services (+30.18%), Information Technology (+28.33%), and Utilities (+26.09%). The worst performing sectors this year have been Energy (+6.44%), Health Care (+7.62%), and Real Estate (+7.68%). On a total return basis, the Russell 1000 Growth Index has increased 24.14% year to date, while the Russell 1000 Value Index has returned 15.40% over the same period.

Related Articles

October 15, 2024

The Markit PMI Manufacturing Index declined to 47.3 for September, as output and new orders fell.

October 1, 2024

Final revisions for US GDP confirmed a 3% growth rate during Q2, up from a growth rate of 1.6% for Q1.

September 15, 2024

The Markit PMI Manufacturing Index came in at 47.9 for August, confirming a trend of weakness in the manufacturing sector.