March 1, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The U.S. Index of Leading Economic Indicators was down 0.40% in January versus having been down 0.20% in December. The Chicago Purchasing Managers Index came in at 44 for January versus 46 for December. The University of Michigan Consumer Sentiment Index was 79.6 for February versus 78.8 for January. New Single-Family Home Sales were 661,000 annualized units, a bit higher than in December. Producer Prices were up 0.30% for the month ended January, however they were only up 0.90% for the year ended January.

Fixed Income

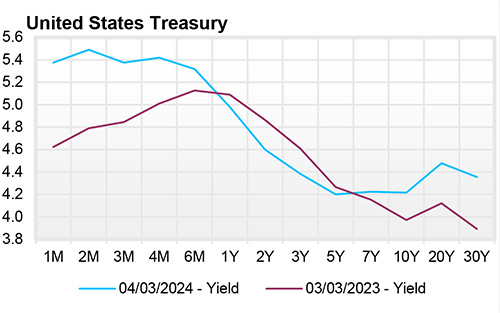

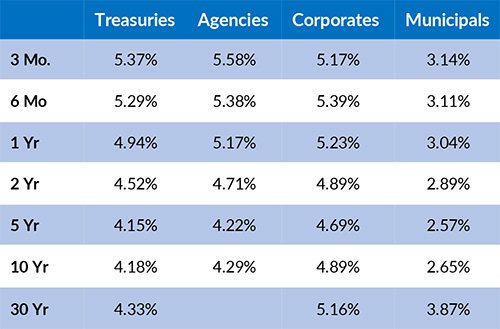

The U.S. Treasury Yield Curve remains inverted; however, this inversion has continued to remain somewhat flat, with the 10-year yield at 4.19%, 34 basis points below the 2-year yield of 4.53%. The U.S. Treasury Yield Curve has now been inverted for 19-20 months. At its recent meeting in late January, the FOMC left the Federal Funds target rate range at 5.25% - 5.50%. During Jerome Powell's speech at the January meeting, he emphasized that the Federal Reserve is moving closer to cutting interest rates. However, he also stated it was unlikely that rate cuts would begin in March. U.S. T-bills do not trade solidly at 5.00% (below the lower end of the FOMC’s Fed Funds Rate Range) until late November 2024, which is a good guess at a date for a possible rate cut.

Yield Curve

Current Generic Bond Yields

Equity

US Equity is positive for the year as the S&P 500 index has a strong 7.22% return. The notable story in February involves the Fed shifting expectations for a rate cut. Months prior, the expectation was largely for a cut in March, though the expectation is now for three 25bps cuts this year, starting in June/July. This is all very data dependent as CPI numbers continue to be released, as well as the stock market making all-time highs and jobs continuing to be fairly strong factoring into the equation.

Technology (+9.50%) and Communication Services (10.13%) have led sectors for the year with the help of AI and semiconductor companies, which seem to be driving most of the market momentum for the moment. Alongside this narrative - Growth (+11.65%) is outperforming Value (+3.61%) by a large margin. On the defensive side of things, Utilities (-2.54%) are the only sector to be negative for the year.

Related Articles

January 15, 2024

The Markit PMI Manufacturing Index came in at 47.9 for December, approximately in-line with November.

February 1, 2024

U.S. Industrial Production was flat for December, with Capacity Utilization also flat at 78.6%.

February 15, 2024

The ISM Manufacturing Index was 49.1 for January, a bit better than the 47.1 level for December.