March 15, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The ISM Manufacturing Index was 47.8% for February, a bit lower than the 49.1 level for January. The Markit PMI Manufacturing Index was 52.2 for February. The Chicago Purchasing Managers’ Index was 44.0 for February versus 46.0 for January. U.S. Durable Goods Orders were down 6.10% MoM in February. Industrial Production was up 0.10% in February and Capacity Utilization was 78.3%. The Markit Services PMI came in at 52.30 for February, and the ISM Services PMI came in at 52.6 also for February. Retail Sales were up 0.60% in February. The University of Michigan Sentiment Index was 76.5 for February versus 76.9 for January. The NFIB Small Business Index was 89.4 for February, down slightly from January. The U.S. Unemployment Rate was 3.9% for February versus 3.7% for January. Consumer Prices were up 0.40% for February and up 3.20% over the past 12 months. Producer Prices were up 0.6% for February and up 1.6% over the past 12 months. Finally, Average Hourly Earnings were up 4.30% in February (annualized rate).

Fixed Income

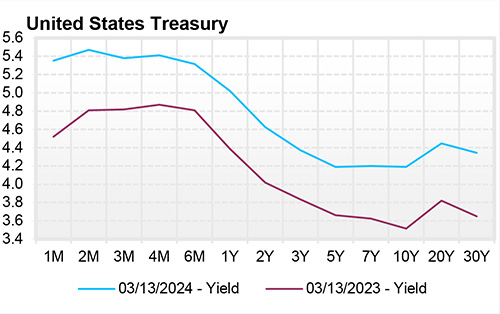

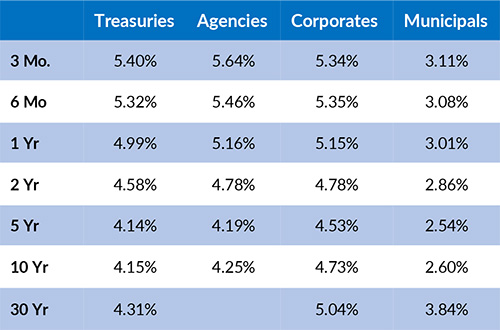

The U.S. Treasury Yield Curve remains inverted; however, this inversion has continued to remain somewhat flat, with the 10-year yield at 4.19%, 44 basis points below the 2-year yield of 4.63%. The U.S. Treasury Yield Curve has now been inverted for 20 months. At its recent meeting in late January, the FOMC left the Federal Funds target rate range at 5.25% - 5.50%. The next FOMC meeting will occur March 19-20. Jerome Powell recently testified before the House Committee on Financial Services. He reiterated the sentiment that rate cuts are likely in 2024. However, he also noted the FOMC needs additional confirmation that inflation will not return before making its first rate cut.

Yield Curve

Current Generic Bond Yields

Equity

US Equity remains strong for the year as the S&P 500 is up 7.60% Year-to-date and sitting at all-time highs. The main focus of the week was on the big data releases: CPI and PPI coming in hotter than expected and initial jobless claims being below consensus which shows signs of the resilient labor market; besides these releases, the market had a relatively uneventful week. Market breadth remains solid as big tech is a mixed bag and other sectors post positive returns.

With a 5% increase in March, Energy leads all sectors (+9.21%), with Communication Services (+9.12%) and Financials (+8.48%) not far behind. Utilities (+0.21%) struggle with Consumer Discretionary (-0.43%) having the only negative return. Tech (+6.83%) saw a sizeable decline for the month as the sector fell -2.43%. Growth (+10.16%) continues to outperform Value (4.60%) by a sizeable margin.

Related Articles

February 1, 2024

U.S. Industrial Production was flat for December, with Capacity Utilization also flat at 78.6%.

February 15, 2023

The ISM Manufacturing Index was 49.1 for January, a bit better than the 47.1 level for December.

March 1, 2024

The U.S. Index of Leading Economic Indicators was down 0.40% in January versus having been down 0.20% in December.