April 1, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

U.S. Industrial Production was up 0.10% for February, after having been down 0.50% in February. Capacity Utilization remained strong and flat for February, at 78.3%. The Chicago Purchasing Managers’ Index took a fairly hard dive in March, to 41.4 from 44.0 in February, both numbers being contractionary. U.S. Real GDP remains strong, at +3.1% as an annualized rate for the fourth quarter of 2023. The NAHB Housing Market Index was also reasonably strong, at 51 in March versus 48 for February. The University of Michigan (Go Blue!) Sentiment Index also improved to 79.4 in March versus 76.9 in February. The U.S. Index of Leading Economic Indicators was reasonably flat for February after having declined by 0.40% in January. Finally, U.S. New Single-Family Home Sales came in at a 662,000 unit annualized rate versus 680,000 expected.

Fixed Income

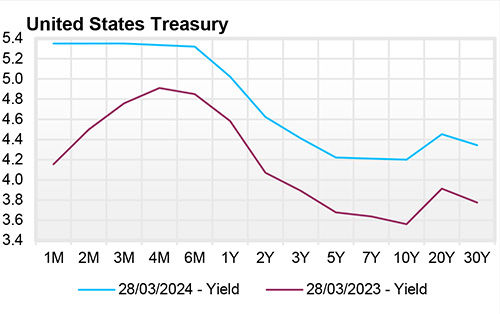

The U.S. Treasury Yield Curve remains inverted, with the 10-year yield at 4.31%, 38 basis points below the 2-year yield of 4.69%. The U.S. Treasury Yield Curve has now been inverted for 20 months. At its recent meeting in late March, the FOMC left the Federal Funds target rate range at 5.25% - 5.50%. The FOMC stated that “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.” This is quite different language than what one is hearing from Wall Street, which continues to be convinced that the FOMC will cut interest rates over the next couple of months.

Yield Curve

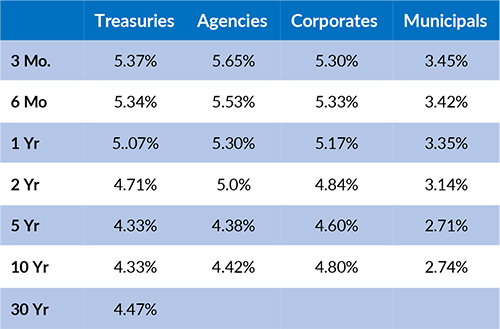

Current Generic Bond Yields

Equity

US Equity were positive in March with all major indices gaining, in which the S&P 500 large cap index logged its fifth straight monthly increase (+2.39%), finishing higher for the 10th month of the past 13 and setting multiple record highs along the way (Factset Research Systems). Market breadth improved in March as the equal weight US large cap index outperformed the cap weighted S&P 500 by 0.96% (RSP: +3.50%; SPY 2.54%). The most notable news for the month was the FOMC meeting which saw an expected rate hold, Chair Powell leaning dovish, and the expectation for 3 cuts maximum with even probability this gets downgraded to fewer cuts.

March saw Value (+3.79%) outperform Growth (+1.45%) though Growth is still leading Value by 5.82% year to date. After a stellar performance, Energy (+13.14%) is one of the leading sectors next to Communication Services (+13.31%) and Financials (+12.03%). All sectors are positive though Utilities (+3.84%) and Consumer Discretionary (+3.20%) lag the most for the year.

Related Articles

February 15, 2024

The ISM Manufacturing Index was 49.1 for January, a bit better than the 47.1 level for December.

March 1, 2024

The U.S. Index of Leading Economic Indicators was down 0.40% in January versus having been down 0.20% in December.

March 15, 2024

The ISM Manufacturing Index was 47.8% for February, a bit lower than the 49.1 level for January.