May 1, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

U.S. Industrial Production was up 0.40% in March, the same rate of increase as April. Capacity Utilization remains a solid 78.4%. The Index of Leading Economic Indicators was down 0.30% in March. 1st Quarter GDP was up 3.0%. New single-family home sales for March came in at a 693,000 unit annualized level, up from February’s 637,000 unit rate. The Chicago Purchasing Manager’s Index came in at a multi-year low of 37.9 for April, versus 41.4 for March.

Fixed Income

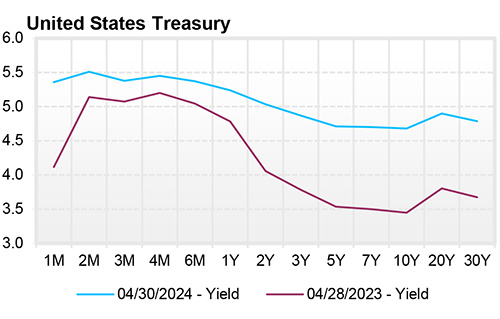

The U.S. Treasury Yield Curve remains inverted; however, this inversion has continued to remain somewhat flat. The 10-year yield is currently 4.63%, 30 basis points below the 2-year yield of 4.93%. The U.S. Treasury Yield Curve has now been inverted for 22 months. At the May 1st meeting, the FOMC left its targeted Fed Funds rate range at 5.25% to 5.50%, as expected. The 1-year TBILL currently yields 5.18%, so using this simple yet effective data point, the market is now pricing in an approximate 30% chance the FOMC cuts rates by this time next year.

Yield Curve

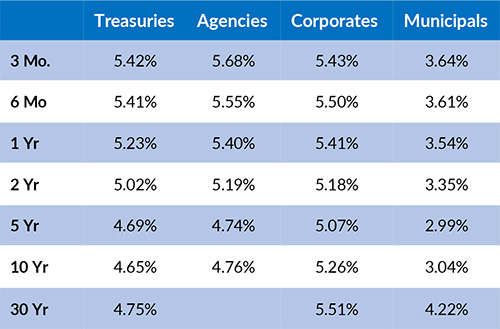

Current Generic Bond Yields

Equity

US Equity struggled for the month of April as the S&P 500 large-cap index gave up -4.22%. Two of the main narratives for the month were CPI coming in hotter than expected and the Fed repricing rate-cut odds to an expectation of one 25bps rate cut for the year. This is another notch in the long line of declining rate cut expectations, which started with around 4-6 cuts only six months ago and has decreased with new economic data pointing towards inflation being more difficult to handle than initially thought.

Utilities (+3.46%) and Consumer Staples (-0.96%) outperform for the month as all other indices are negative with Technology (-6.99%) being the biggest straggler. Energy (+10.64%) is still outperforming year-to-date with Communication Services (+8.44%) not far behind and Consumer Staples (-2.18%) lagging the most.

Related Articles

March 15, 2024

The ISM Manufacturing Index was 47.8% for February, a bit lower than the 49.1 level for January.

April 1, 2024

U.S. Industrial Production was up 0.10% for February, after having been down 0.50% in February.

April 15, 2024

The ISM Manufacturing Index was 50.3 for March, while the PMI Manufacturing Index was 51.9 for March.