June 1, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The Index of Leading Economic Indicators was down 0.6% for the month of April. U.S. Capacity Utilization fell slightly to 78.4% in April, barely below its long run average. U.S. Industrial Production remained unchanged month over month. The U.S. Core PCE Price Index rose 0.2% month over month. On an annual basis, Core PCE has remained unchanged at 2.8% for the past 3 months. Existing Home Sales rose 3.7% month over month, while Pending Home Sales fell 7.7% over the same period. The Chicago Purchasing Managers’ Index fell sharply to 35.4, its lowest reading in 4 years. Finally, the University of Michigan Consumer Sentiment Index fell 10.5% month over month, although it beat consensus expectations of a 12.6% decline.

Fixed Income

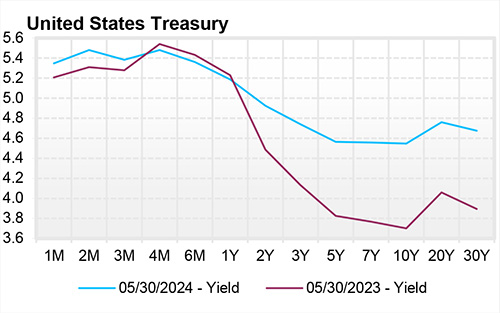

The U.S. Treasury Yield Curve remains inverted; however, this inversion has continued to remain somewhat flat. The 10-year yield is currently 4.51%, 37 basis points below the 2-year yield of 4.88%. The U.S. Treasury Yield Curve has now been inverted for 22.5 months. The FOMC has held its Fed Funds target rate range at 5.25% to 5.50% since last July. Economists fully expect that the European Central Bank will cut rates for the first time on June 6. The ECB’s President recently emphasized that the ECB would rely on their economic data and not necessarily look to the Federal Reserve’s policy stance as a baseline for their own policy decisions. The next FOMC Meeting is scheduled for June 12, 2024. Currently, the CME FedWatch tool indicates an 84% chance that the Federal Reserve will cut rates at least once in 2024.

Yield Curve

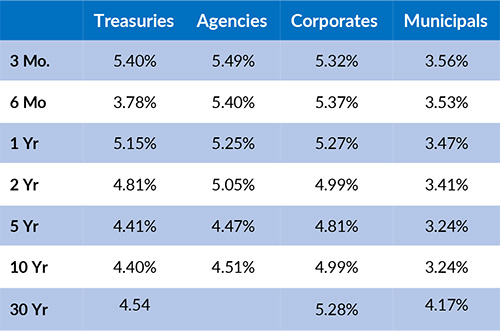

Current Generic Bond Yields

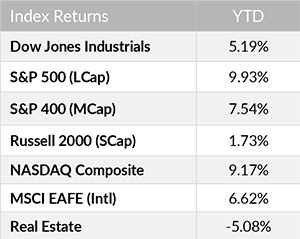

Equity

The S&P 500 concluded May with a 4.8% monthly increase, concluding the month with around an 11% return. Year to date, the leading sectors are Communication Services (+20.71), Utilities (+12.42%), and Information Technology (+18.05). The sectors with the lowest performance this year include Real Estate (-4.95%), Consumer Discretionary (+0.22%), and Materials (+5.14%).

S&P 500 Growth (+15.82%) is outperforming S&P 500 Value (+4.99%). Even with positive performance almost across the board, US consumer confidence decreased 8.9 points in the last four months.

Related Articles

April 15, 2024

The ISM Manufacturing Index was 50.3 for March, while the PMI Manufacturing Index was 51.9 for March.

May 1, 2024

U.S. Industrial Production was up 0.40% in March, the same rate of increase as April.

May 15, 2024

The ISM Manufacturing Index fell to 49.2 in April, versus 50.3 in March.