June 15, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

PPI data for May indicated that producer prices fell 0.2% month over month and have risen 2.2% over the past 12 months. Similarly, CPI data revealed that prices for consumers remained unchanged month over month and have risen 3.3% in the past 12 months. The ISM Manufacturing Index was 48.7 for May. The ISM Services PMI was 53.8 in May, a 8.9% increase month over month and the highest print in 9 months. The NFIB Small Business Index was 90.5 for the month of May, up slightly from its 10-year low seen in March (88.5). The U.S. Unemployment Rate rose to 4% in May, it’s highest level since January 2022. Average Hourly Earnings for May increased 4.1% year over year. Finally, the most recent University of Michigan Consumer Sentiment Index result was 65.6 vs. a consensus of 73.

Fixed Income

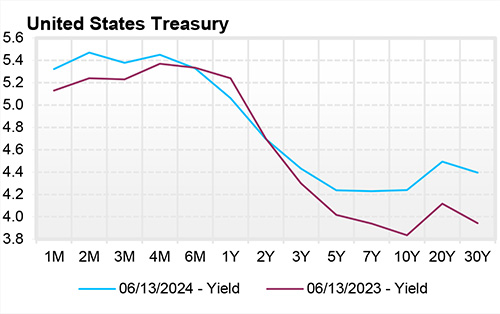

The U.S. Treasury Yield Curve remains inverted; however, this inversion has continued to remain somewhat flat. The 10-year yield is currently 4.20%, 48 basis points below the 2-year yield of 4.68%. The U.S. Treasury Yield Curve has now been inverted for 23 months. Rates across the yield curve have fallen over the past month. Following a rate cut from the Bank of Canada earlier this month, the European Central Bank cut its benchmark rate to 3.75%. This marks the first two G7 Countries to cut rates during this cycle. On June 12, the FOMC board voted unanimously to keep the Fed Funds target rate range at 5.25% to 5.50. During the June meeting, FOMC members forecasted an average of 1 rate cut by the end of the year. This differs from the members’ average forecast of 3 rate cuts in 2024 during the previous meeting.

Yield Curve

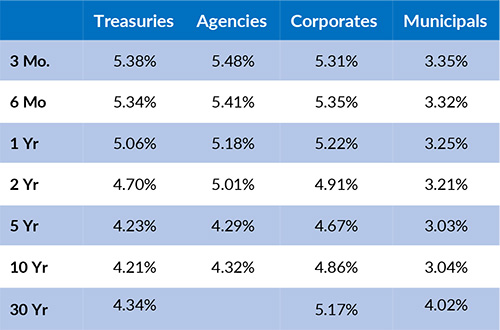

Current Generic Bond Yields

Equity

The S&P 500 index has risen 3.33% since the beginning of June. Equities have performed well since a slight selloff seen in April. Year to date, the best performing sectors have been Information Technology (+28.55%), Communication Services (+22.88%), and Utilities (+9.87%). The worst performing sectors this year have been Materials (+4.48%), Consumer Discretionary (+2.87%), and Real Estate (-4.34%).

Large Cap stock indices have vastly outperformed Small and Mid Cap stock indices this year. Notably, the ‘Magnificent 7’ stocks have returned an average of 36.1% in 2024. The S&P 500 has made over 20 all-time highs this year alone. In terms of valuation, the forward 12-month P/E ratio for the S&P 500 is approximately 20.7. This is slightly above the 10-year average of 17.8.

Related Articles

May 1, 2024

U.S. Industrial Production was up 0.40% in March, the same rate of increase as April.

May 15, 2024

The ISM Manufacturing Index fell to 49.2 in April, versus 50.3 in March.

June 1, 2024

The Index of Leading Economic Indicators was down 0.6% for the month of April.