August 15, 2024

Economic Outlook

The ISM Services PMI was 51.4 for the month of July. The NFIB Small Business Index was 93.7 in July, the highest reading since February 2022. In the same period, the U.S. Unemployment Rate rose to 4.3%, the highest level in nearly 3 years. Average Hourly Earnings for July increased 3.6% year over year. The most recent University of Michigan Consumer Sentiment Index result was 66.4, the lowest reading of 2024. Capacity Utilization for July was 77.8%. On an annualized basis, the Producer Price Index rose 2.2% and the Consumer Price Index rose 2.9%. Both inflation readings were largely in line with consensus estimates.

Fixed Income

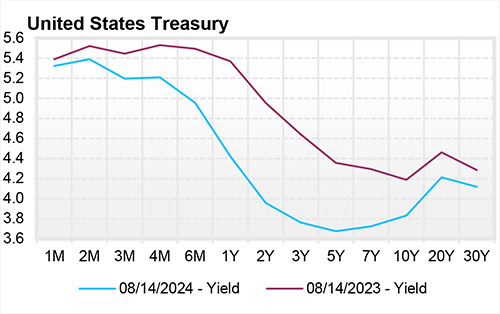

At the July FOMC meeting, members voted to keep the federal funds rate target unchanged at 5.25-5.50%. In recent weeks, many economists have publicly stated their fears that the Fed is acting too slow as it relates to cutting their target rate. After a few soft prints of economic data, rates across the Treasury yield curve dropped sharply in early August. The longest yield curve inversion in history was briefly interrupted earlier this month. The CME Fedwatch Tool currently predicts rate cuts totaling 75-100 bps by year-end. The next FOMC meeting is scheduled for September 17-18, 2024.

Yield Curve

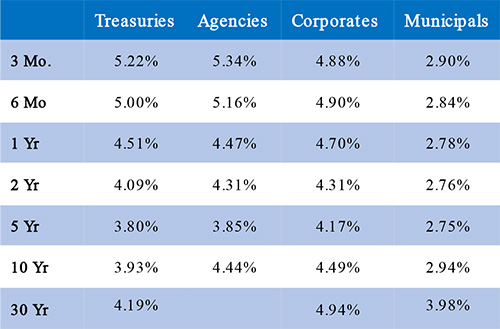

Current Generic Bond Yields

Equity

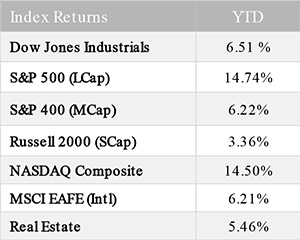

Equity markets lost some momentum in late July. Markets signaled a modest negative reaction to the July FOMC meeting. Due to overall position concentration and negative repercussions from the Yen carry trade, risk assets experienced a spike in volatility. Volatility levels quickly reverted to historically normal levels. During the past month, the equal-weight S&P 500 index has slightly outperformed the market cap-weighted S&P 500 index. The NASDAQ 100 fell over 10% during a three-week pullback. Zooming back out, equities have still delivered strong returns this year, with the S&P 500 Index up 14.74%.

Year to date, the best performing sectors have been Information Technology (+22.86%), Communication Services (+21.54%), and Utilities (+16.81%). The worst performing sectors this year have been Real Estate (+4.30%), Materials (+4.04%), and Consumer Discretionary (+0.73%).

Related Articles

August 1, 2024

July ISM Manufacturing Index came in below expectations at 46.8 v. consensus estimates of 48.9 and June’s reading of 48.5.