September 15, 2024

Economic Outlook

The Markit PMI Manufacturing Index came in at 47.9 for August, confirming a trend of weakness in the manufacturing sector. The ISM Services PMI came in at 51.5 for August vs expectation of 51.1. During the same period, the NFIB Small Business Optimism Index fell to 91.2 after a notable increase the prior month. The U.S. Unemployment Rate fell to 4.2% for August, the first decrease in six months. The Producer Price Index was up 0.2% for August and up 1.7% year over year; this yearly change is now well below the long-run annual increase in producer prices of 3.07%. The Consumer Price Index rose 0.2% for August. Year over year, consumer prices rose 2.5%, the fifth consecutive month of annualized declines. Average hourly earnings in the U.S. have increased 3.8% year over year and continue a slow yet consistent decline in 2024.

Fixed Income

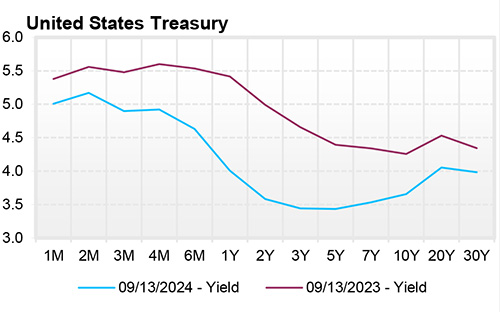

The current federal funds target rate is 5.25-5.50%. Rates along the U.S. Treasury Yield Curve continue to fall as the FOMC is expected to lower the federal funds rate this week. This would represent the first federal funds rate cut in over four years. The 10-year yield is currently 3.66%, 8 basis points above the 2-year yield of 3.58%. Generally, yields on shorter duration bonds have fallen faster than longer duration bonds, a trend that may continue if multiple rates cuts occur before year end. Futures markets are split on whether the September FOMC meeting will result in a 50 bps or 25 bps rate cut. The FOMC is expected to announce an updated fed funds target rate on Wednesday, September 18.

Yield Curve

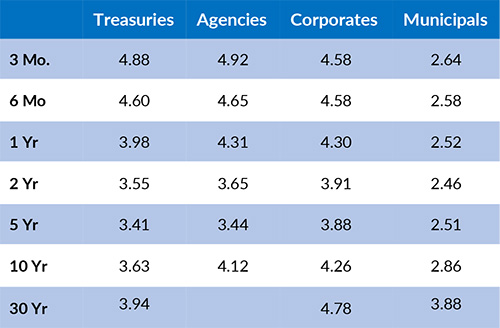

Current Generic Bond Yields

Equity

Equities experienced a strong bounce back during the last few trading sessions. Last week, major equity returns included: S&P 500 +4.02%, Nasdaq +5.95%, Russell 2000 +4.36. This comes after the S&P 500 posted its worst weekly performance since March 2023 and the Nasdaq since January 2022 for the week ending September 6, 2024. The S&P 500 is back within striking distance of an all-time high.

Year to date, the best performing sectors have been Information Technology (+25.69%), Utilities (+21.47%), and Communication Services (+19.89%). The worst performing sectors this year have been Energy (+1.41%), Materials (+6.99%), and Consumer Discretionary (+8.52%). On a total return basis, the Russell 1000 Growth Index has increased 20.93% year to date, while the Russell 1000 Value Index has returned 12.86% over the same period.

Related Articles

August 1, 2024

July ISM Manufacturing Index came in below expectations at 46.8 v. consensus estimates of 48.9 and June’s reading of 48.5.