January 1, 2025

Economic Outlook

The NHAB Housing Market Index was 46 for the month of December, unchanged from the November reading. The US Leading Economic Index was 99.7 for the month of November, the first month over month increase since February 2024. U.S. Industrial production decreased -0.9% year over year in November. The University of Michigan Consumer Sentiment Index came in at a final reading of 74 for December, continuing the steady increase seen over the past 6 months. 5-Year Breakeven Inflation Expectations are 2.38%, remaining elevated relative to the recent lows seen in September 2024. Capacity Utilization in the U.S. dropped to 76.8%, around 3% below the long-run average. Average hourly earnings for all employees on US private nonfarm payrolls increased by 4% year over year in November. The week of January 6th features a busy calendar of new economic data releases; headline reports include Markit PMI Services on Monday, ISM Services on Tuesday, and The Employment Situation report on Friday. The average interest rate for a 30-year fixed rate mortgage has risen to 6.97%, the highest reading since July 2024.

Fixed Income

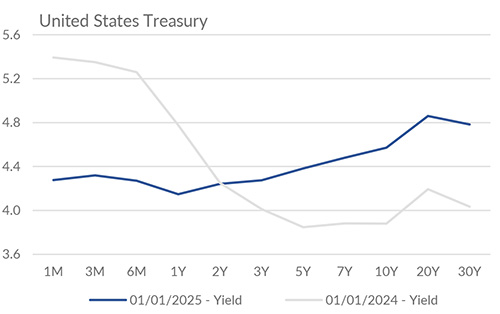

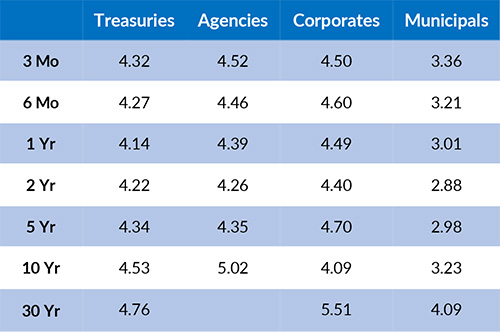

The current federal funds target rate is 4.25-4.50%. The 10-year yield is currently 4.53%, 31 basis points above the 2-year yield of 4.22%. Although the FOMC has cut rates by 100 bps since September, Treasury yields of intermediate and long duration continue to rise. Seasoned investment-grade bond yields currently have the lowest spread relative to 10-year Treasury yields since the mid-to-late 1990’s. Meanwhile, mortgage rates have risen nearly 100 bps since the start of the FOMC’s rate-cutting cycle. The options market indicates low probability for a rate cut at the next meeting scheduled for January 28-29, 2024. Market participants continue to expect a slower pace of rate cuts in 2025, with two 25 bps rate cuts in 2025 seen as the most likely outcome.

Yield Curve

Current Generic Bond Yields

Equity

Happy 2025! The S&P 500 finished 2024 with a total return of 25%, the second year in a row to finish above 20%. The total return for the equal-weighted S&P 500 was approximately 11%. The market topped essentially all analysts’ initial targets for 2024. For 2025, analysts are expecting the S&P to grow to the 6500-6600 range by the end of the year. The constituents of the S&P 500 are forecasted to record 2024 annual earnings growth of 9.5%, with a large portion of the growth due to the Magnificent 7. The historical average 10-year earnings growth is 8%.

In 2024, the best performing sectors were Communication Services (+38.89%), Information Technology (+35.69%), Consumer Discretionary (+29.13%), and Financials (+28.43%). The worst performing sectors were Health Care (+0.90%), Materials (+1.83%), and Real Estate (+1.72%). On a total return basis, the Russell 1000 Growth Index increased 33.35% in 2024, while the Russell 1000 Value Index returned 14.35%.

Related Articles

December 15, 2024

The Markit PMI Manufacturing Index increased to 48.4 for November, as inventories and employment rebounded.

November 15, 2024

The ISM Services Index for October increased to 56 for October, the highest reading in two years.