January 15, 2025

Economic Outlook

The Markit PMI Manufacturing Index increased to 49.3 for December, rebounding from the October low and near a neutral reading of 50. The ISM Services PMI came in at 54.1 for December, remaining in expansion territory for the sixth consecutive month. During the same period, the NFIB Small Business Optimism Index sharply increased for the second consecutive month to 105.1. The net percent of small business owners expecting the economy to improve rose 16 points to 52%, the highest since 1983. The Producer Price Index rose 0.2% month over month in December. Producer prices have risen 3.3% from a year ago. The Consumer Price Index rose by 0.2% month over month. Consumer prices have increased 2.9% annually, rising for the third consecutive month. The average interest rate for a 30-year fixed rate mortgage is 6.93%. New economic data releases in the week ahead include Retail Sales on Thursday (Jan 16) and Industrial Production and Capacity Utilization on Friday (Jan 17).

Fixed Income

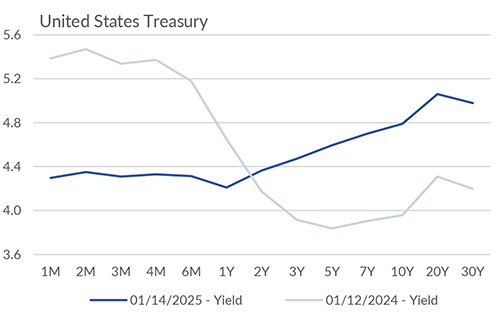

The current federal funds target rate is 4.25-4.50%. The 10-year yield is currently 4.65%, 38 basis points above the 2-year yield of 4.27%. As evidenced by the Yield Curve chart below, yields on the shorter end of the curve have fallen notably alongside FOMC rate cuts. At the same time, yields on the long end of the curve have risen steadily over the past several months. The normalized yield curve we observe today is historically a healthy sign for economic growth. As inflation concerns have grown in recent weeks, the options market now indicates a very low probability of a rate cut during the January or March FOMC meetings.

Yield Curve

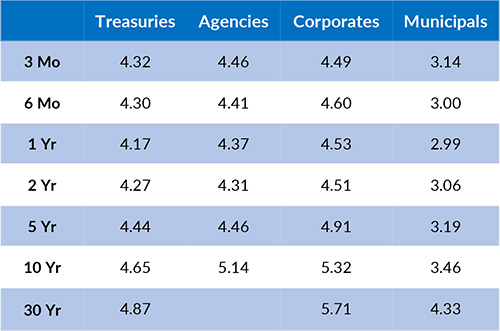

Current Generic Bond Yields

Equity

The S&P 500 is amidst a bull market which has notched +20% returns over each of the past two years. Similarly, the NASDAQ Composite has led the way with outsized gains during the same period. A strong sign for equity markets, U.S. Real GDP growth rose approximately 3% over the past year, compared with an average of 2% growth for the next 10 largest economies. Current Real GDP projections indicate the U.S. will experience growth in line with peers during 2025. This coincides with a current Forward P/E Ratio for the S&P 500 of 21.36, compared with a median value of approximately 18 since inception.

In 2025, the best performing sectors have been Energy (+6.17%), Materials (+2.48%), Industrials (+2.04%). The worst performing sectors have been Information Technology (-2.66%), Consumer Staples (-2.25%), and Real Estate (-1.63%). On a total return basis, the Russell 1000 Growth Index has decreased 1.53% year to date, while the Russell 1000 Value Index has gained 0.98% over the same period.

Related Articles

January 1, 2025

The NHAB Housing Market Index was 46 for the month of December, unchanged from the November reading.

December 15, 2024

The Markit PMI Manufacturing Index increased to 48.4 for November, as inventories and employment rebounded.