November 1, 2025

Economic Outlook

The Atlanta Federal Reserve projects an annualized real GDP growth rate of 4.0% for Q3 2025. The ISM Manufacturing PMI registered 48.7 in October, signaling continued contraction in factory activity. Consumer sentiment eased, with the University of Michigan’s final October reading at 53.6, down from 55.1 in September. Inflation expectations remain mostly contained, with the 5-year breakeven inflation rate at 2.40% as of October 31. Housing indicators improved modestly as the NAHB Housing Market Index rose five points to 37 in October. The average interest rate for a 30-year fixed rate mortgage was approximately 6.17% as of October 30. Several key economic data series have yet to be updated since the federal government shutdown began one month ago.

Fixed Income

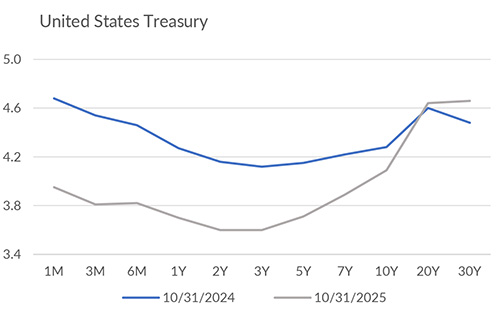

The Federal Reserve lowered the federal funds target range by 25 bps on October 29 to 3.75%–4.00%, marking the second consecutive meeting with a rate cut. The Board also announced that quantitative tightening will end on December 1. Despite the Fed’s actions, Treasuries all along the yield curve have moved higher. The 30-year Treasury yield rose from 4.55% on October 28 to 4.68% by November 3. Meanwhile, the 2-year Treasury yield edged up from 3.49% to 3.59% during the same period. Interest rate volatility continues to ease, with the ICE BofA MOVE Index making new year to date lows. The next FOMC meeting is scheduled for December 9-10, and market participants have become more cautious about the likelihood of another rate cut. Chair Powell cautioned during his October press conference that a December cut is “not a foregone conclusion.”

Yield Curve

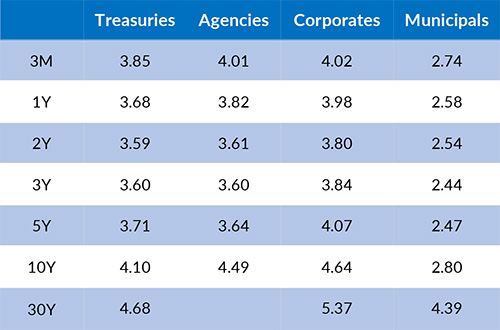

Current Generic Bond Yields

Equities

The S&P 500 produced a total return of 2.34% in October 2025, extending its streak of six consecutive monthly gains. Concentration in U.S. equity markets remains elevated: the top 10 firms now account for over 40% of the index, a record high according to Morningstar data. Q3 earnings results have been robust so far. As of October 31, 64% of S&P 500 companies had reported Q3 results, with roughly 83% posting positive EPS surprises. The blended earnings growth rate for the S&P 500 for Q3 is currently 10.7%. While mega-cap tech and AI-linked names have powered the move to new all-time highs, breadth is showing some signs of weakness. Last Friday, around 6.59% of the S&P 500 made a 52- week low, the highest share since April. Additionally, only 37% of S&P 500 stocks are above their 50- day moving average.

In 2025, the best performing U.S. sectors have been Information Technology (+29.93%), Communication Services (+26.82%), and Utilities (+20.17%). The worst performing sectors have been Consumer Staples (+1.49%), Real Estate (+2.91%), and Materials (+3.80%). On a total return basis, the Russell 1000 Growth Index has returned 21.50% year to date, while the Russell 1000 Value Index has increased 12.15% over the same period.

Related Articles

October 15, 2025

In September, the ISM Services PMI registered at 50.0, indicating neutral levels of service sector activity.

September 15, 2025

In August, the ISM Services PMI rose to 52.0, indicating modest expansion in the services sector.