February 1, 2025

Economic Outlook

The ISM Manufacturing Index was 50.9 for January, the highest reading since September 2022. The NHAB Housing Market Index was 47 for the month of January, the highest reading in nine months. The US Leading Economic Index inched down to 101.6 for the month of December, remaining above the multi-year low seen in September 2024. U.S. Industrial production increased 0.5% month over month in December. The University of Michigan Consumer Sentiment Index posted a final reading of 71.1 for January. The 5-Year Breakeven Inflation Rate is 2.54%, remaining elevated relative to the lows seen in September. Capacity Utilization in the U.S. dropped to 77.6%. Average hourly earnings for all employees on US private nonfarm payrolls have increased by 3.9% year over year in December. The first week of February features a busy calendar of new economic data releases; headline reports include the ADP National Employment Report on Wednesday and the January Jobs Report on Friday. The average interest rate for a 30-year fixed rate mortgage has risen to 6.95.

Fixed Income

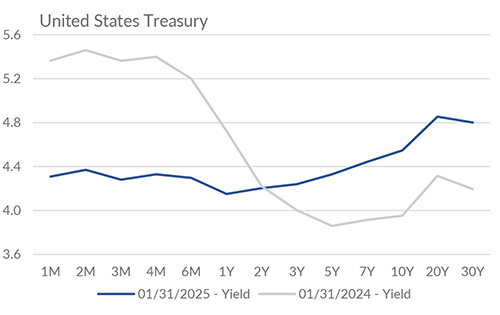

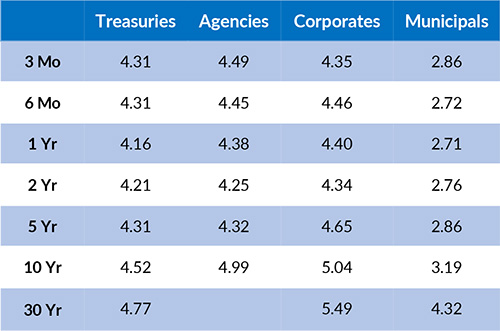

The Federal Reserve left its target rate unchanged at 4.25-4.50% during the December FOMC meeting. This pause follows three consecutive meetings in which the FOMC previously cut rates. The 10-year yield is currently 4.52%, 31 basis points above the 2-year yield of 4.21%. Long-duration Treasury bond yields have risen 40-50 bps since their lowest levels in early December. The spread between the ICE BofA US High-Yield Index Yield and the 10-Year Treasury Yield remains near the lowest levels observed since the former’s inception in 1997. This may be explained by a high level of investor confidence in the economy and corporate creditworthiness, or it could reflect a search for higher yields in a lower interest rate environment. The next FOMC meeting is scheduled for March 19, 2025. Options markets are pricing in nearly a 90% chance that the Federal Reserve will leave rates unchanged in March.

Yield Curve

Current Generic Bond Yields

Equity

The S&P 500 is up slightly year-to-date. Every sector within the index is positive for the year outside of technology. Notably, technology holds the largest sector weighting in the index, at 30.41%. Equity markets are processing news of potential tariffs that will impact some of the U.S.’ largest trade partners. There may be continued volatility in the markets as the news and impact will change over the coming months. The industries most impacted by recently proposed tariffs include food, automakers, and consumer goods.

In 2025, the best performing sectors have been Communication Services (+9.17%), Health Care (+7.14%), Materials (+5.52%). The worst performing sectors have been Information Technology (-4.24%), Consumer Staples (+2.46%), and Energy (+2.54%). On a total return basis, the Russell 1000 Growth Index has increased 1.95% year to date, while the Russell 1000 Value Index has gained 4.48% over the same period.

Related Articles

January 15, 2025

The Markit PMI Manufacturing Index increased to 49.3 for December, rebounding from the October low and near a neutral reading of 50.

January 1, 2025

The NHAB Housing Market Index was 46 for the month of December, unchanged from the November reading.

December 15, 2024

The Markit PMI Manufacturing Index increased to 48.4 for November, as inventories and employment rebounded.