March 1, 2025

Economic Outlook

The U.S. Leading Economic Index was 101.5 in January, barely changed from December. The ISM Manufacturing Index fell slightly to 50.3 in February from 50.9 in the prior month. U.S. Industrial Production increased 2% year-over-year in January, the largest 12-month change since 2022. The University of Michigan Consumer Sentiment Index fell sharply to 64.7 in February, reaching a 15-month low amid rising uncertainty. The 5-Year Breakeven Inflation Rate climbed to 2.59% this week. Capacity Utilization in the U.S. manufacturing sector rose to 77.8% in January. Average hourly earnings rose 4.1% year-over-year in January. The NAHB Housing Market Index declined to 42 in February, reflecting continued softness in the housing sector. US Real GDP increased 2.8% in 2024. The average interest rate for a 30-year fixed-rate mortgage fell to 6.76%, the lowest level since mid-December.

Fixed Income

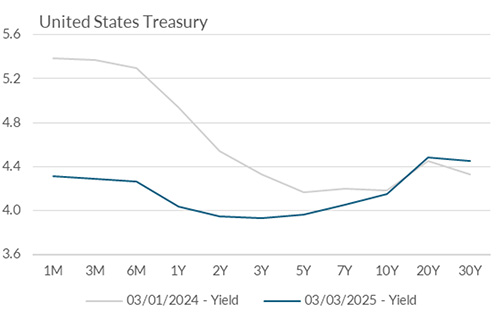

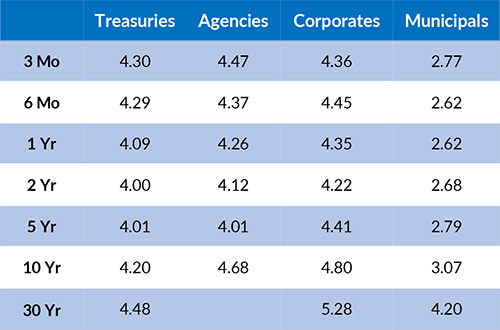

The Federal Reserve has maintained the federal funds target rate at 4.25-4.50%, following three consecutive rate cuts totaling 100 basis points since September 2024. Yields across the curve have fallen since the brief spike in yields in mid-January, with a sharp drop in the past week. The 30-year Treasury yield has fallen from its highest point in 2024 of 4.97% to today’s level of 4.48%. Likewise, the 10-year Treasury yield has fallen from a high of 4.79% to 4.20%. The Treasury yield curve remains normalized with a 2-year to 10-year spread of 20 bps. As evidenced by the ICE BofA US High-Yield Index, credit spreads remain near multi-decade lows. Expectations relating to FOMC rate cuts have shifted slightly, with futures markets pricing in approximately 75-100 bps of rate cuts by year end.

Yield Curve

Current Generic Bond Yields

Equity

The U.S. equity markets have experienced volatility recently, with major indices such as the S&P 500 and Nasdaq Composite recording notable declines. Investor sentiment has turned decidedly bearish, influenced by escalating trade tensions and concerns over economic growth. Despite these challenges, some analysts argue that fears of a recession may be overblown, citing the resilience of the American economy. In this environment, it is crucial for investors to maintain perspective, recognizing that market cycles include periods of volatility and uncertainty. In fact, since 1928, the S&P 500 has declined by 5% an average of 3.4 times per year.

In 2025, the best performing sectors have been Health Care (+8.45%), Consumer Staples (+8.23%), and Financials (+6.83%). The worst performing sectors have been Information Technology (-7.67%), Consumer Discretionary (-7.62%), and Communication Services (-0.73%). This year, the Russell 1000 Growth Index has decreased (-4.12%) year to date, while the Russell 1000 Value Index has gained 3.98% over the same period.

Related Articles

February 15, 2025

In January 2025, the Markit PMI Manufacturing Index increased to 51.2, continuing its modest improvement in recent months.

February 1, 2025

The ISM Manufacturing Index was 50.9 for January, the highest reading since September 2022.

January 15, 2025

The Markit PMI Manufacturing Index increased to 49.3 for December, rebounding from the October low and near a neutral reading of 50.