March 15, 2025

Economic Outlook

In February 2025, the ISM Services PMI unexpectedly increased to 53.5 from 52.8 the prior month, indicating continued expansion in the services sector. The NFIB Small Business Optimism Index dropped 2.1 points to 100.7 in February, still well above the average reading over the past three years. The U.S. Unemployment Rate rose slightly to 4.1% in February. Retail sales rose 0.2% month-over-month in February and remain 3.1% higher year-over-year, signaling continued consumer resilience. The Consumer Price Index increased by 0.2% month-over-month in February, with consumer prices up 2.8% annually. The Producer Price Index remained unchanged from a month ago, following an upward revision of the January report. Producer prices have increased 3.2% from a year ago. The preliminary University of Michigan Consumer Sentiment Index reading for March fell sharply to 57.9, with many respondents citing a rise in economic uncertainty.

Fixed Income

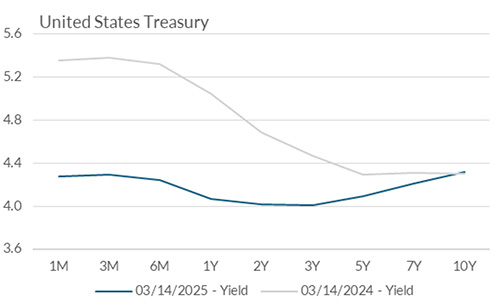

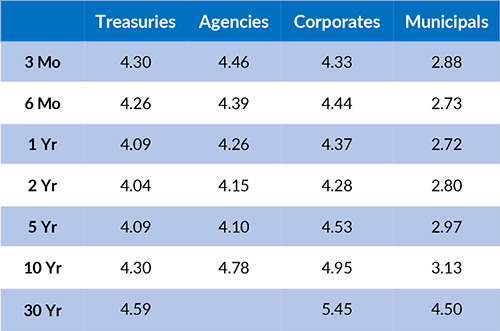

The U.S. Treasury Yield Curve remains relatively flat, with 10-year yield at 4.30%, 26 basis points below the 2-year yield of 4.04%. The Federal Reserve has maintained the federal funds target rate at 4.25-4.50%. Amid a correction in the equity market, credit spreads have remained tight. As of March 14, the spread between the ICE BofA US High Yield Index effective yield and the 10-year Treasury yield was approximately 3.04%, while the 20 year average is nearly 4.7%. The next FOMC meeting is scheduled for this week, although no change to the target rate is expected. Yields across the curve have fallen since the start of the year. Market participants expect 50-75 bps of rate cuts in 2025, with around a 75% chance of a cut at the May FOMC meeting.

Yield Curve

Current Generic Bond Yields

Equity

The U.S. equity markets have experienced notable volatility recently, with the S&P 500 entering correction territory after declining over 10% from its February highs. Month-to-date, the S&P 500 has fallen -4.26% and the NASDAQ Composite has fallen -5.04%. Sentiment among retail investors remains decidedly bearish, with the March 13 AAII Sentiment Survey identified 59.24% of respondents were bearish.

In 2025, the best performing sectors have been Health Care (+5.05%), Energy (+3.99%), and Utilities (+3.46%). The worst performing sectors have been Consumer Discretionary (-13.82%), Information Technology (-9.45%), and Communication Services (-3.43%). This year, the Russell 1000 Growth Index has decreased (-7.95%) year to date, while the Russell 1000 Value Index has gained 0.61% over the same period.

Related Articles

February 15, 2025

In January 2025, the Markit PMI Manufacturing Index increased to 51.2, continuing its modest improvement in recent months.

February 1, 2025

The ISM Manufacturing Index was 50.9 for January, the highest reading since September 2022.