April 1, 2025

Economic Outlook

The U.S. Leading Economic Index was 101.1 in February, slightly down from January. The ISM Manufacturing Index fell to 49.0 in March from 50.3 in February. U.S. Industrial Production increased 1.4% year-over-year in February, showing continued growth. The University of Michigan Consumer Sentiment Index dropped to 57.0 in March, reflecting the third consecutive monthly decline. The 5-Year Breakeven Inflation Rate is currently at 2.54%, indicating moderate inflation expectations. Capacity Utilization in the U.S. manufacturing sector increased to 78.2% in February, the first instance of three consecutive monthly increases since early 2022. Average hourly earnings rose 4.0% year-over-year in February, maintaining healthy growth. The NAHB Housing Market Index fell to 39 in March, signaling continued challenges in the housing sector. The average interest rate for a 30-year fixed-rate mortgage is approximately 6.65%, near the lowest levels over the past 6 months.

Fixed Income

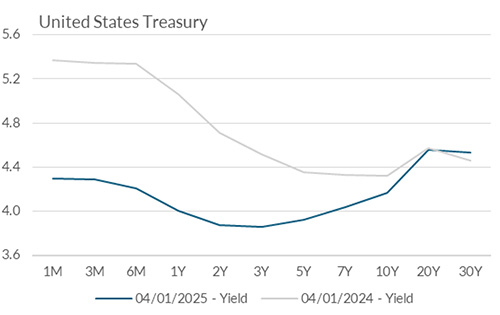

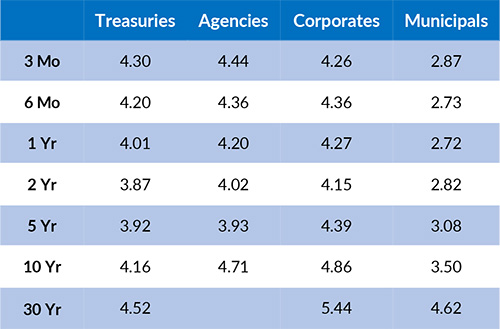

The U.S. Treasury Yield Curve remains relatively flat, with 10-year yield at 4.16%, 29 basis points below the 2-year yield of 3.87%. The current Fed Funds target range is 4.25-4.50%. Interest rates across the yield curve have continued to trend downward since a recent peak in mid-January. The next FOMC meeting is scheduled for May 6-7, 2025. Futures markets are pricing in a low probability for a May cut. The probability of a cut at the June meeting is around 60%.

Yield Curve

Current Generic Bond Yields

Equity

U.S. equity markets have seen defensive sectors outperform in 2025, reflecting a shift towards stability amid economic uncertainty. Conversely, high-beta stocks have struggled, marking a period of extreme relative underperformance. In light of these dynamics, it is important to remember that volatility is a natural part of market cycles. Since 1928, the S&P 500 Index has declined by 10% an average of 1.1 times per year. International developed markets are up over 8% in 2025, with emerging markets also up single digits thus far.

In 2025, the best performing sectors have been Energy (+9.94%), Consumer Staples (+4.87%), and Utilities (+4.43%). The worst performing sectors have been Consumer Discretionary (-12.99%), Information Technology (-11.96%), and Communication Services (-5.46%). This year, the Russell 1000 Growth Index has decreased (-9.19%) year to date, while the Russell 1000 Value Index has gained 2.06% over the same period.

Related Articles

March 15, 2025

In February 2025, the ISM Services PMI unexpectedly increased to 53.5 from 52.8 the prior month.

February 15, 2025

In January 2025, the Markit PMI Manufacturing Index increased to 51.2, continuing its modest improvement in recent months.