April 15, 2025

Economic Outlook

The Markit PMI Manufacturing Index fell to 49 in March from February's reading of 50.3, pointing to a slight contraction in factory activity. The ISM Services PMI came in at 50.8 for March, indicating the lowest expansion in the services sector since June 2024. During the same period, the NFIB Small Business Optimism Index fell to 97.4, indicating cautious optimism among small business owners. The U.S. Unemployment Rate rose slightly to 4.2% in March. Surprisingly, the Consumer Price Index fell by 0.1% month-over-month in March, with consumer prices up 2.4% annually. The Producer Price Index fell 0.4% month-over-month, the first decrease since October 2023. Producer prices rose 2.7% from a year ago. The slowing of consumer and producer price increases in March is seen as encouraging to investors. However, April price data (to be released May 13-15) will be more consequential as it will include the initial impact of tariffs. The average interest rate for a 30-year fixed-rate mortgage as of April 10 was 6.62%. New economic data releases this week include Retail Sales and Industrial Production on Wednesday (April 16).

Fixed Income

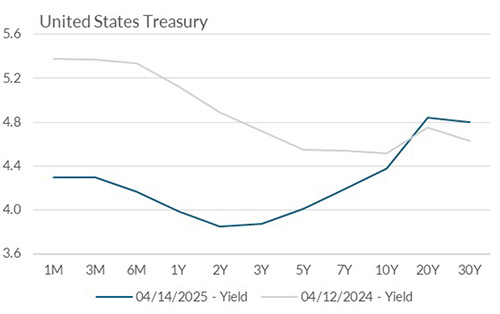

The current federal funds target rate is 4.25-4.50%. The 2-year yield is currently 3.83%, 51 basis points below the 10-year yield of 4.34%. The U.S. Treasury Yield Curve remains somewhat flat, with yields on the shorter end of the curve relatively stable following recent FOMC meetings. Yields for longer maturity bonds rose sharply in recent sessions, likely driven by inflation concerns, equity market volatility, and the potential for geopolitical restructuring. These impacts were likely exacerbated by investors raising cash, further impacting bond prices and yields. Futures markets anticipate three or four 25 bps rate cuts by year-end. The next FOMC meeting is scheduled for May 6-7, 2025.

Yield Curve

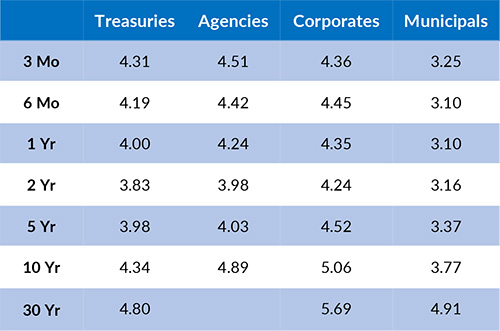

Current Generic Bond Yields

Equity

Defensive sectors continue to outperform relative to the S&P 500 in 2025. Volatility, as measured by the CBOE Volatility Index (VIX), recently reached one of the highest levels since COVID and the Great Financial Crisis, with a reading of 60.13 as several major stock indices fell in response to tariff news and negotiations. After trading lower for four consecutive days, the S&P 500 index posted a 9.52% singleday return on April 9 following a 90-day pause in broad-based tariff increases. This marked the third best daily return for the index since 1940. Recent trading sessions serve as a reminder that equity markets’ best and worst days typically occur in close proximity.

In 2025, the best performing sectors have been Consumer Staples (+5.40%), Utilities (+2.55%), and Health Care (+0.69%). The worst performing sectors have been Consumer Discretionary (-17.10%), Information Technology (-14.76%), and Communication Services (-8.82%). On a total return basis, the Russell 1000 Growth Index has decreased -12.11% year to date, while the Russell 1000 Value Index has fallen -3.20% over the same period.

Related Articles

March 15, 2025

In February 2025, the ISM Services PMI unexpectedly increased to 53.5 from 52.8 the prior month.