May 15, 2025

Economic Outlook

In April, the S&P Global U.S. Manufacturing PMI held steady at 50.2, indicating marginal expansion in the manufacturing industry. The ISM Services PMI rose to 51.6, suggesting modest growth in the services sector. The NFIB Small Business Optimism Index declined by 1.6 points to 95.8 in April, continuing a steady decline since December 2024. The U.S. economy added 177,000 jobs in April, with the unemployment rate unchanged at 4.2%. Retail sales increased by 0.1% month over month, normalizing from the 1.7% surge in March. The Consumer Price Index rose by 0.2% in April, bringing the annual inflation rate to 2.3%. The Producer Price Index decreased by 0.5% month over month, with the annual rate softening to 2.4%. The average interest rate for a 30-year fixed-rate mortgage as of May 9 was 6.86%.

Fixed Income

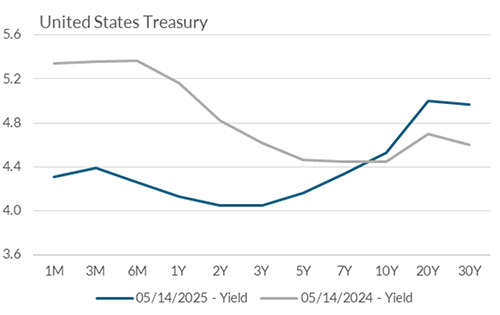

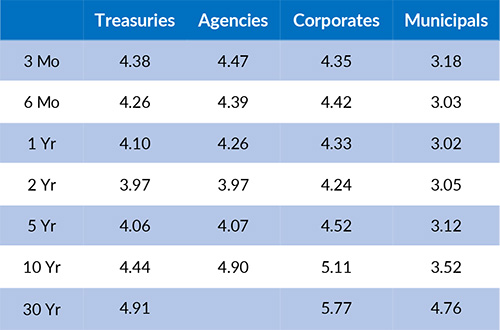

The Federal Reserve recently held the federal funds target rate steady at 4.25-4.50% at the May FOMC meeting. Policymakers continue to seek clearer evidence of sustained disinflation amid global tariff negotiations. The 2-year Treasury yield is currently 3.97%, 47 basis points below the 10-year yield of 4.44%. Yields have edged higher over the past two weeks, with the 30-year yield approaching 5% in recent sessions. FOMC members continue to emphasize further patience in recent comments. As a result, futures markets currently anticipate just two 25 bps rate cuts by year-end. The next FOMC meeting is scheduled for June 17-18, 2025.

Yield Curve

Current Generic Bond Yields

Equity

Equity markets appear to have stabilized in May, following nearly a 20% decline in the S&P 500 index in early April. The index now sits near breakeven for the year. The sharp retracement comes amid a series of positive headlines regarding international tariff negotiations. At the same time, economic data relating to labor markets and recent earnings forecasts have remained resilient. After a prolonged period of outperformance by U.S. large cap stocks, International Developed equities have returned nearly 14% year to date.

In 2025, the best performing U.S. sectors have been Industrials (+6.62%), Financials (+5.20%), and Utilities (+4.46%). The worst performing sectors have been Health Care (-6.51%), Consumer Discretionary (-4.99%), and Information Technology (-0.76%). On a total return basis, the Russell 1000 Growth Index has returned -0.28% year to date, while the Russell 1000 Value Index has increased 1.78% over the same period.

Related Articles

April 15, 2025

The Markit PMI Manufacturing Index fell to 49 in March from February's reading of 50.3.