June 15, 2025

Economic Outlook

In May, the ISM Services PMI declined to 49.9, indicating a modest contraction in the services sector. The NFIB Small Business Optimism Index rose to 98.8, reflecting a slight rebound in sentiment following four consecutive monthly declines. The U.S. unemployment rate remained steady in May at 4.2%, suggesting stability in labor market conditions. The Consumer Price Index rose by 0.1% in May, bringing the annual inflation rate to 2.4%. The Producer Price Index increased by 0.1% over the same period, with the annual rate rising to 2.6%. The preliminary University of Michigan Consumer Sentiment Index rose to 60.5 in June, with improved perceptions amid easing inflation and tariff concerns. The average interest rate for a 30-year fixed-rate mortgage as of June 12 was 6.84%.

Fixed Income

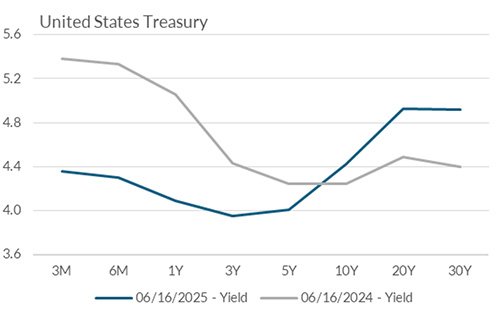

The Federal Reserve held the federal funds target rate steady at 4.25–4.50% at the May FOMC meeting, as policymakers continue to weigh mixed economic signals. The 2-year Treasury yield currently sits at 3.95%, 47 basis points below the 10-year yield of 4.42%, reflecting a modest steepening curve. Yields on both the short and long end of the yield curve have largely remained unchanged over the past month. Credit spreads remain tight relative to their long run averages, even after experiencing a run up in yields in mid-April. Futures markets now expect the target rate to be lowered by 50 bps by year-end. The next FOMC meeting is scheduled for June 17-18 where no change to the target rate is expected.

Yield Curve

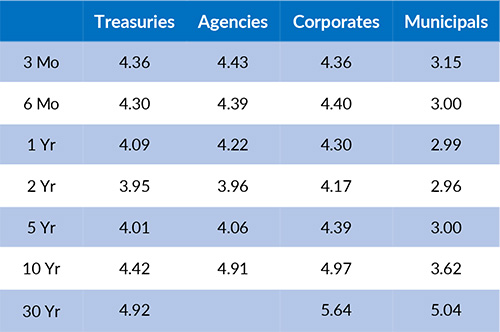

Current Generic Bond Yields

Equity

U.S. equity markets staged a strong rebound in May following a steep 19% drawdown earlier this year, with the S&P 500 now slightly positive for the year. This equity rally was supported by resilient corporate earnings, easing inflation pressures, and a temporary de-escalation in tariff rhetoric from Washington. Notably, developed international equities have outperformed U.S. stocks year-to-date by one of the widest margins seen in over a decade, driven by strong relative earnings growth and more favorable currency dynamics. Meanwhile, geopolitical uncertainty and shifting trade policy remain key variables for equity volatility heading into the second half of the year. Markets will be closely watching the July FOMC meeting and upcoming corporate earnings season for further direction.

In 2025, the best performing U.S. sectors have been Industrials (+7.95%), Utilities (+6.76%), and Communication Services (+5.63%). The worst performing sectors have been Consumer Discretionary (-6.74%), Health Care (-1.40%), and Information Technology (+1.02%). On a total return basis, the Russell 1000 Growth Index has returned 1.23% year to date, while the Russell 1000 Value Index has increased 3.13% over the same period.

Related Articles

May 15, 2025

In April, the S&P Global U.S. Manufacturing PMI held steady at 50.2, indicating marginal expansion in the manufacturing industry.