July 15, 2025

Economic Outlook

In June, the ISM Services PMI rose to 50.8, up slightly from 49.9 in May, indicating relatively stable service sector activity. The NFIB Small Business Optimism Index came in at 98.6 in June, nearly unchanged month over month. The unemployment rate fell to 4.1% in June, signaling stability in the labor market. The annual inflation rate in the US rose for the second consecutive month to 2.7% in June, the highest rate of inflation since February. Consumer sentiment is showing early signs of stabilization, with the University of Michigan Consumer Sentiment Index rising to 60.7 in June from 52.2 in May. The average interest rate for a 30-year fixed-rate mortgage as of July 10 was 6.72%.

Fixed Income

The Federal Reserve continues to hold its target range steady at 4.25–4.50%, maintaining its pause amid resilient economic data. Meanwhile, the 10-year Treasury yield has risen to 4.44%, near a four-month high. The 2-year Treasury yield sits at 3.96%, rising modestly from the start of July. In the corporate bond market, high yield spreads have fallen back near multi-year lows after briefly spiking in April. The next FOMC meeting is set for July 30–31, with markets largely expecting a hold as the Fed weighs new inflation data and labor market dynamics.

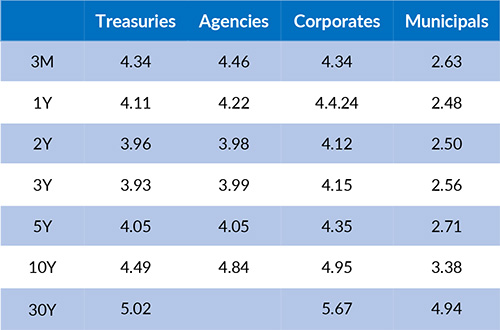

Yield Curve

Current Generic Bond Yields

Equity

U.S. equities have delivered a steady rally into mid-July, with the S&P 500 reaching all-time highs and year to date returns exceeding 7%. This rally has been led by strong earnings from both mega-cap technology names and select cyclicals, notably industrials and utilities. As major U.S. indices have rebounded, both institutional and individual investor sentiment have experienced a quick recovery. Currently, the CBOE Market Volatility Index sits near 17.38, trending near its lowest levels of 2025. This week marks the unofficial start of the Q2 earnings season. On June 30, the estimated earnings growth rate for the S&P 500 this quarter was 4.9%.

In 2025, the best performing U.S. sectors have been Industrials (+15.40%), Communication Services (+10.21%), and Utilities (+10.87%). The worst performing sectors have been Consumer Discretionary (-1.74%), Health Care (-0.93%), and Energy (+4.86%). On a total return basis, the Russell 1000 Growth Index has returned 7.18% year to date, while the Russell 1000 Value Index has increased 7.27% over the same period.

Related Articles

July 1, 2025

The U.S. Leading Economic Index declined to 99.0 in May, signaling potential headwinds for future economic activity.

June 15, 2025

In May, the ISM Services PMI declined to 49.9, indicating a modest contraction in the services sector.