March 15, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The U.S. Unemployment Rate came in at a rate of 3.6% for February versus 3.4% for January. Average Hourly Wages were up 0.2% for February versus +0.3% for January. The Consumer Price Index was up 0.4% in February, after having been up 0.5% in January. The year-over-year inflation rate for the U.S. as of February was 6.0%, down from 6.4% as of January. Producer Prices were down 0.1% in February after having been up 0.3% in January. U.S. Retail Sales were down 0.4% in February after having been up 3.22% in January. Finally, the NAHB Homebuilder Survey came in at 44 for March vs. 42 for February.

Fixed Income

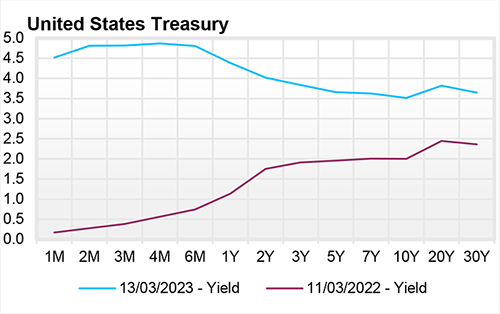

The U.S. Treasury Yield Curve remains inverted, with the 10-year yield trading at 3.57%, 61 basis points below the 2-year yield of 4.18%. Overall, yields have shifted down rather dramatically over the past week, from 4.07% to 3.57%. It is difficult to say whether this was due to the stock market selling off, however, as bonds were up far more than one would expect for such a small stock market decline. Further, the positive correlation between stock prices and bond prices looks to be very much intact looking back from late September 2022 until today. March 21st and 22nd is the next Federal Reserve Open Market Committee meeting.

Yield Curve

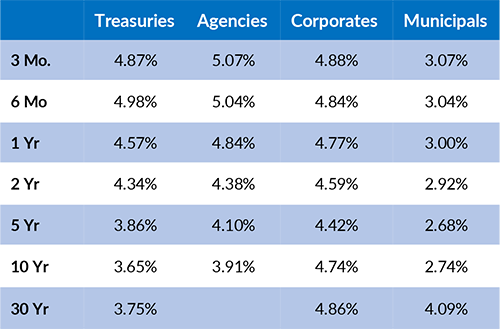

Current Generic Bond Yields

Equity

US Equity is down for the month but remains positive for the year as the S&P 500 is up 2.26% year-to-date. All eyes are on the collapse of Silicon Valley Bank as the broad financial sector is feeling some form of reverberation even though the event is idiosyncratic to banks with large deposits from tech startups and venture capitalists. Due to the aftermath of this event, the Fed rate path has flattened sharply (though it has been extremely volatile even to the time of this writing). The market is now pricing in a 75% chance of a 25 bps hike in March, a 60% change of a 25 bps hike in May and then rate cuts are expected to start in June, with the market expecting three 25bps cuts by the end of the year (Factset Research Systems).

Technology (+11.68%) and Communication Services (+11.64%) continue to lead the sectors year to date while Health Care (-7.21%), Financials (-5.23%) and Energy (-5.54%) have been hit the hardest. Growth is outperforming Value 3.38% to 0.86% respectively.

Related Articles

February 1, 2023

The Index of Leading Economic Indicators was down 1.0% in December, following a 1.0% move down in November.

February 15, 2023

The ISM Manufacturing Index was 47.4 for January vs. 48.4 for December, while the S&P Purchasing Managers Index was 46.9 for January versus 46.8 for December.

March 1, 2023

U.S. Consumer Spending was up 1.8% for January, after having been down 0.1% in December.