March 31, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

U.S. Durable Goods Orders were down 1.0% in February, after having been down 5.0% in January. Industrial Production was flat in February versus +0.3% in January. Capacity Utilization was flat for February, at 78.0%. The Chicago Business Barometer for March was 43.8, roughly in line with February’s number. The University of Michigan Consumer Sentiment was back down to 62.0 in March from 63.4 in February. Personal Income was up 0.3% in February after having been up 0.6% in January. Personal Spending was up 0.2% in February after having been up 1.8% in January. Finally, new single-family home sales came in at 640,000 units for February, up slightly from January.

Fixed Income

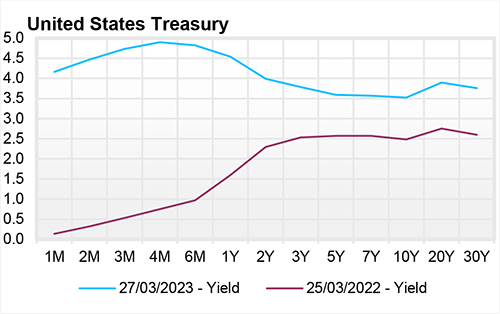

The U.S. Treasury Yield Curve remains inverted, with the 10-year yield trading at 3.50%, 55 basis points below the 2-year yield of 4.05%. At its recent March meeting, the FOMC raised the Federal Funds target rate 0.25%, to a range of 4.75% -5.00%. The FOMC commented that “the U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.” As of today, the fixed-income market is not pricing in any more interest rate increases from the FOMC.

Yield Curve

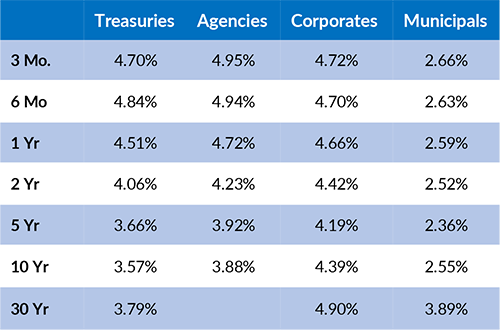

Current Generic Bond Yields

Equity

US Equity is slightly positive for the month as the S&P 500 is up .35% at the time of writing (March 28th). All eyes continue to be on banks and the Fed. Notably, optimism was taken from the lack of additional major banks making headlines and the cleanup of the financial sector’s trouble, such as the mergers and acquisitions taking place. The market is pricing in a 50/50 split of the Fed raising another 25 bps in May vs holding steady, and then beginning to cut near summer (though as we’ve seen with the recent market volatility, this information can change daily).

Since the beginning of the year, growth has seen a rebound after underperforming the value space. Growth is up 5.62% for the year with Communication Services (+16.63%), Technology (15.47%), and Consumer Discretionary (+9.64%) leading the way. Value is up 1.35% with Energy (-7.03%) and Financials (-7.95%) lagging the most.

Related Articles

February 15, 2023

The ISM Manufacturing Index was 47.4 for January vs. 48.4 for December, while the S&P Purchasing Managers Index was 46.9 for January versus 46.8 for December.

March 1, 2023

U.S. Consumer Spending was up 1.8% for January, after having been down 0.1% in December.

March 15, 2023

The U.S. Unemployment Rate came in at a rate of 3.6% for February versus 3.4% for January.