April 15, 2023

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

U.S. Factory Orders were down 0.7% in February versus having been down 2.1% in January. The Markit Purchasing Managers Index was 49.2 for March versus 49.3 for February. The ISM Manufacturing Index was 46.3 for March versus 47.7 for February. U.S. Industrial Production was up 0.4% in March, after having been up 0.2% in February. Capacity Utilization was a strong 79.8%. The U.S. Unemployment Rate was 3.5% for March, down slightly from the 3.6% level in February. Average Hourly Earnings were up 0.3% in March and up 4.2% in February. Producer Prices fell by 0.5% in March after having been flat in February. Finally, Consumer Prices rose a smaller 0.1% in March, and +5.0% for the year ended in March.

Fixed Income

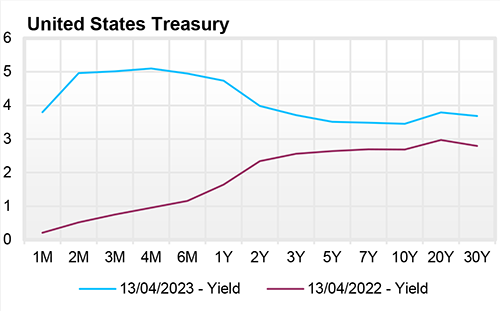

The U.S. Treasury Yield Curve remains inverted, with the 10-year yield trading at 3.52%, 59 basis points below the 2-year yield of 4.11%. At its recent March meeting, the FOMC raised the Federal Funds target rate 0.25%, to a range of 4.75% -5.00%. On April 11, Minneapolis Fed President Kashkari said that "It could be that our monetary policy actions and the tightening of credit conditions because of this banking stress leads to an economic downturn. That might even lead to a recession," however he also noted "We need to get inflation down. ... If we were to fail to do that, then your job prospects would be really hard." As of today, the fixed-income market is pricing in a higher probability of another 0.25% interest rate hike from the FOMC in the next few months.

Yield Curve

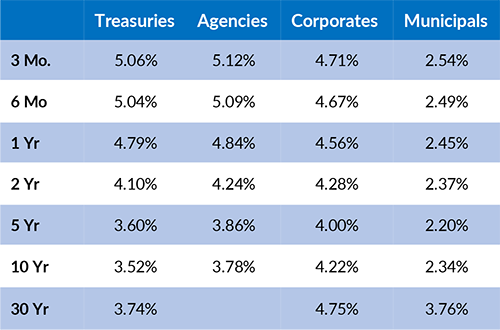

Current Generic Bond Yields

Equity

US Equity is positive month-to-date as the S&P 500 is up 1.20%. Market narrative focuses on the traction of disinflation with March’s headline inflation print coming in lower than expected which is a positive for equity. However, even with this surprise, it is still expected the Fed will raise rates at their upcoming meeting in May, with expectations then shifting to the Fed quickly changing course and cutting rates near the end of this summer/early fall.

After underperforming value all of 2022, growth has since taken back its lead as the index is up 11.14% year-to-date versus value’s 6.08%. The return has largely been led by tech, specifically the mega cap tech names, as the sector is up 20.34% for the year. Communication Services (+23.73%) and Consumer Discretionary (+14.36%) are the other leading sectors. Financials (-3.33%) and Utilities (-1.08%) lag and are the only sectors year-to-date with negative performance.

Related Articles

March 1, 2023

U.S. Consumer Spending was up 1.8% for January, after having been down 0.1% in December.

March 15, 2023

The U.S. Unemployment Rate came in at a rate of 3.6% for February versus 3.4% for January.

March 31, 2023

U.S. Durable Goods Orders were down 1.0% in February, after having been down 5.0% in January.