January 1, 2024

The Portfolio Manager Commentary is provided by Trustmark’s Tailored Wealth Investment Management team. The opinions and analysis presented are accurate to the best of our knowledge and are based on information and sources that we consider to be reliable and appropriate for due consideration1.

Economic Outlook

The U.S. Index of Leading Economic Indicators was down 0.50% in November after having been down 1.00% in October. The NAHB Housing Market Index was stuck at a weak 37 in December versus 34 in November. New Single-Family Home sales came in at a 590,000 annual unit rate in November versus 672,000 in October. The University of Michigan Consumer Sentiment Index remained a depressed 69.7 for December versus 69.4 for November. The Chicago Purchasing Managers’ Index also dipped back into contracting levels at 46.9 for December versus 55.8 for November year over year.

Fixed Income

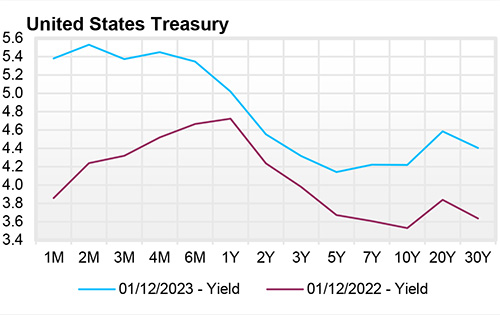

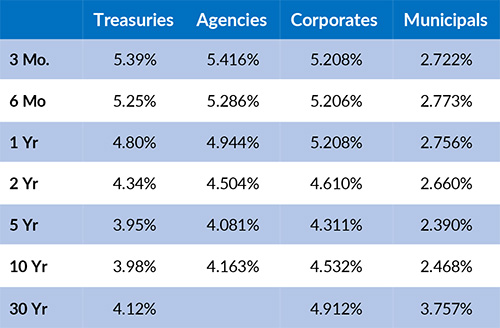

The U.S. Treasury Yield Curve remains inverted; however, this inversion has continued to remain somewhat flatter, with the 10-year yield at 3.92%, 42 basis points below the 2-year yield of 4.34%. The U.S. Treasury Yield Curve has now been inverted for 17 months. At its recent meeting, the FOMC left the Federal Funds target rate range at 5.25% - 5.50%. The FOMC also removed language that implied future interest rate increases and introduced language that implied future interest rate cuts. The FOMC also noted that the U.S. Unemployment Rate will likely continue trending higher to the 4.1% level. The three-month and six-month U.S. Treasury Bills currently yield in a range of 5.25%-5.38%, which is within the range of the FOMC’s current Fed Funds rate target. The one-year U.S. Treasury Bill is now yielding 4.80%, slightly below the target rate in anticipation of a future interest rate cut.

Yield Curve

Current Generic Bond Yields

Equity

The S&P 500 ended 2023 up (+26.02%) with Consumer Discretionary (+39.52%), Communication Services (+52.65%), and Technology (+55.85%) leading the way. The only negative sector returns for the year were in Consumer Staples (-0.84%), Energy (-0.75%), and Utilities (-7.13%), which are typically the more defensive sectors. S&P Growth (+29.69%) outperformed S&P Value (+21.85%), with the main driver of the relative outperformance being technology. The only US Indices that outperformed the S&P was the NASDAQ Composite Index (+43.42%), which is comprised of over 2,500 international and US-based stocks that are heavily weighted toward the technology sector, followed by consumer discretionary and healthcare.

The S&P has been inching closer to the January 3, 2022, all-time high, largely based on optimism that the Federal Reserve will cut rates sharply in 2024. Broadening strength and participation creates room for the markets to move higher.

Related Articles

November 15, 2023

U.S. Durable Good Orders were up 4.6% annualized in September after having a similar increase in August.

December 1, 2023

U.S. Durable Goods Orders were down 5.4% in October versus having been up in September.

December 15, 2023

U.S. Durable Goods Orders were down 5.4% in October.